Credit Counseling American Consumer Credit Counseling

Credit Counseling & Debt Consolidation: Overcoming Financial Challenges In spite of being diligent about using credit cards within a reasonable budget, unforeseen events can happen.

Credit card debt has become a silent intruder in people’s lives. It can be challenging to keep track of your daily expenses when using credit cards. Unlike cash, where you physically see the money leaving your wallet with each purchase, credit card charges accumulate quietly throughout the month. Small transactions soon add up to a shocking bill by the end of the month, and if not paid on time, additional charges and fees may be added.

Even responsible credit card users who stick to a practical budget can fall victim to unexpected events. Car or home repairs, medical bills, or family emergencies can force individuals to rely solely on their credit cards. Lost in the struggle to regain financial stability, it becomes easy to overlook interest payments, minimum payment percentages, and APRs. Even those who choose to consolidate their debts still face the burden of repayment.

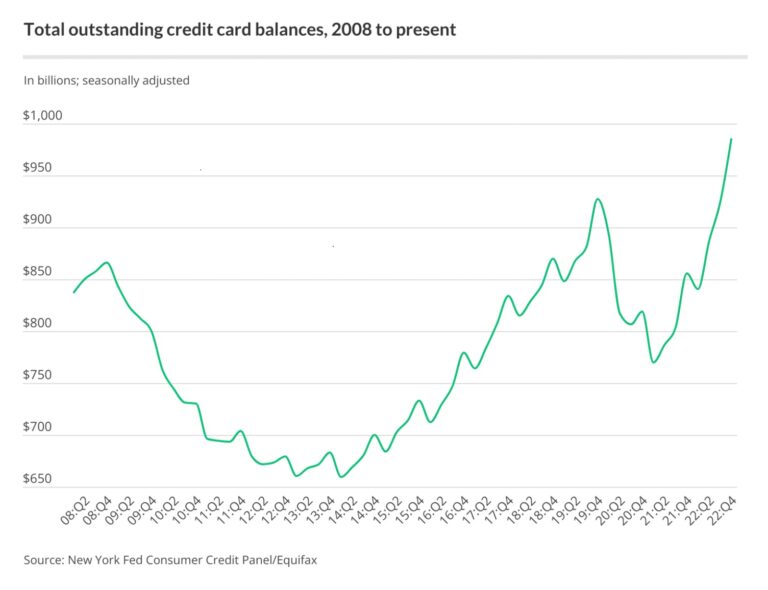

As of December 2022, the average credit card debt among cardholders with unpaid balances in the country was $7,279, encompassing both bank cards and retail credit cards. This mounting debt has become an alarming issue, affecting millions of individuals who must face the consequences of escalating balances and high-interest rates. The problem has consistently worsened over the years and saw a temporary slowdown during the pandemic. However, as life returns to normal, credit card debts are once again on the rise.

Credit Counseling & Debt Consolidation: Overcoming Financial Challenges In spite of being diligent about using credit cards within a reasonable budget, unforeseen events can happen. Whether it’s an unexpected car repair, a medical bill, or a family emergency, your credit card can quickly become your only means of payment. It’s easy to lose track of the high interest rates, minimum payment percentages, and APRs while trying to get back on track. Even if you’ve consolidated all your credit lines into a single payment with a consolidation loan, the burden of repayment still lingers.

Individuals experiencing financial difficulties face unique situations. Therefore, a consumer credit counseling service differs from simply obtaining a consolidation loan. Although a debt consolidation loan may appear to be the only choice, when you contact the counseling center of Ickontrol.net teams, we will assist you in determining the most suitable approach to your circumstances and offer the most optimal credit counseling service alternatives.

Once you reach out to our counseling agency, a professionally trained debt counselor will:

Assist you in assessing your present financial state. Offer a detailed evaluation of your income, assets, and expenses. Provide personalized options based on your objectives. If the Debt Management Program is the most appropriate option for you, we will furnish you with complete program details.

Upon completion of the counseling session, you will be relieved to know that there are available alternatives and that you are not alone. Ickontrol.net teams are here to support and provide you with the most effective debt solutions for you and your specific situation.

Struggling with Debt?

Contact now at (Free)

0090 539 500 46 95

We are here to assist you! Ickontrol.net can provide you with personalized Debt Management Counseling to assist you with:

-

Significantly reducing your interest rates and monthly payments (up to 30-50%).

-

Consolidating all your credit card bills into a single, manageable monthly payment.

-

Putting an end to the constant harassment from debt collectors Obtaining a 100% free consultation with a experienced financial advisor.

-

Becoming Debt-Free within a timeframe of 3-5 years (in most cases).